SDG financing needs an urgent global reboot

At the mid-point on the way to 2030, SDG financing is under pressure. Reforms of the global finance system, and more targeted financing solutions, are needed to get back on track to meet the Global Goals

Financing — Global

The Sustainable Development Goals (SDGs) will help to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. But achieving the SDGs requires significant public and private investment, especially in poor and vulnerable countries. We urgently need an SDG investment plan in areas of critical importance for humanity and the planet (physical infrastructure, human capital, and the environment).

The SDSN’s SDG Transformations framework (Sachs et al., 2019) provides a clear, actionable agenda to allocate adequate funding and resources to the SDGs, and to address trade-offs and leverage synergies across them. The SDG Transformations identify 6 areas where countries need to invest the most to advance on the 2030 Agenda, while building resilience against shocks and crises:

- education and social protection

- health systems

- energy decarbonization and sustainable industry

- sustainable food, land use, and protection of biodiversity and ecosystems

- sustainable urban infrastructure

- universal digital services

SDG financing is under pressure and unevenly distributed

While substantial financing is required to achieve the SDG Agenda by 2030, the ongoing “Triple C” crisis – COVID-19, climate change, and conflict – is mounting pressure on resources to finance the SDGs. Due to the pandemic, in 2019–20 the total volume of financing for sustainable development flows to developing countries (excluding China) declined by 17%, with government revenue and private capital flows experiencing the sharpest drops (Organisation for Economic Co-operation and Development (OECD), 2022). Increasingly gloomy contractions are expected in 2022, especially in portfolio flows (50%) and foreign direct investment (FDI, 23%) (OECD, 2022). If not stopped, Russia’s war against Ukraine and the worsening of climate change will put financing for sustainable development under additional stress.

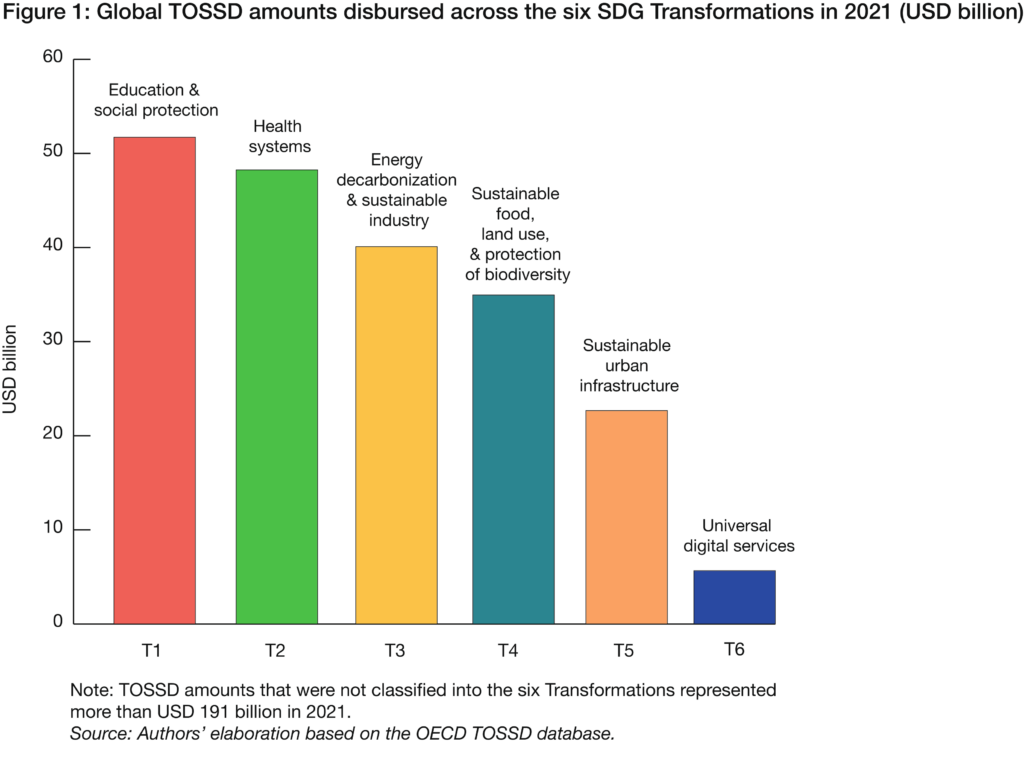

Compared with more volatile private capital flows, official development assistance (ODA) is a key countercyclical source of SDG financing, but it remains unevenly distributed across the six SDG Transformations. This poses important challenges for achieving some of the SDGs and maximizing investment synergies across the different Goals. The OECD’s Total Official Support for Sustainable Development (TOSSD) database shows that, overall, official funding resources for sustainable development increased by more than 20% between 2019 and 2020, in response to the pandemic and the recession in developing countries. Nevertheless, as Figure 1 shows, some key areas of investment for sustainable development still receive much less funding than others. While during the pandemic official funds providers seem to have invested significantly in education (T1) and health (T2), too little emphasis has been put on investments for ensuring sustainable resource use and curbing pollution (T4), for making cities more sustainable (T5), and especially for promoting digitalization (T6). Transformation 3, which refers to investment for climate action (including financing for adaptation and to deal with loss and damage), has also not been a priority of international official assistance.

Another challenge is that financing for sustainable development is often not directed to countries that need it the most, including highly vulnerable countries. Recent SDSN analysis using the Multidimensional Vulnerability Index and the SDG Index shows that reaching the SDGs is more challenging for highly vulnerable countries such as small island developing states, notwithstanding their income level (Massa and Bermont Díaz, 2022; Massa, 2021). However, these countries are often neglected by investors. A study by the Overseas Development Institute (ODI) shows that countries getting the highest amounts of climate resilience finance are not among the most vulnerable countries to climate change and natural hazards, while the most vulnerable countries receive less than the average resilience finance flows (Wilkinson et al., 2023).

Closing the SDG financing gap and enhancing SDG investment effectiveness

The “scissors effect” – rising financing needs to achieve sustainable development coupled with decreasing SDG financing resources – has led to a considerable SDG financing gap. According to the OECD (2022), following the outbreak of the COVID-19 pandemic, the SDG financing gap in developing countries has widened by more than 55% to reach USD 3.9 trillion per year.

Three key steps are needed to help policymakers close the SDG financing gap and to guide SDG investment decisions within and across countries in a more effective way.

1. Urgently provide SDG financing gap measures at a more sectoral level

Different approaches have been developed to estimate the SDG financing gap at the global or regional level. Yet, these numbers are not directly actionable and often suffer from major data gaps, especially with respect to poor and vulnerable countries. To make concrete progress on closing the SDG financing gap, policymakers need to know in which specific areas SDG investment is lacking or insufficient. A more granular approach is therefore needed. The SDSN is working to build a bottom-up approach to estimate the SDG financing gap at the six SDG Transformations level and to assess trade-offs and synergies between SDG investments. The newly created SDG Impact Investment Toolkit is also useful to identify which investment opportunities have the greatest SDG impact potential.

2. Adapt SDG financing flows and instruments to country-specific needs

Although various mechanisms are currently used to finance the SDGs, a more strategic and tailored approach is needed to ensure that financing solutions address country-specific needs. While ODA could support countries characterized by high economic and developmental vulnerabilities in achieving the SDGs, other financing tools such as insurance mechanisms and compensation funds could be more useful in economies highly exposed to the adverse consequences of climate change. In vulnerable countries crippled by heavy debt burdens, debt swaps (such as debt-for-climate swaps) could be used to restructure the growing debt and free up resources for the SDGs.

3. Reform the global finance system to enhance access to concessional finance and to allow more sovereign borrowing on international capital markets

Multilateral development banks represent one of the main sources of finance for the SDGs. Yet, many vulnerable countries cannot access concessional finance because of their relatively high income levels. To allow these countries to progress towards the achievement of the SDGs, we must urgently revise the criteria of access to concessional finance by integrating a measure of vulnerability.

The credit rating system should also be reformed. Nowadays, international rating agencies do not provide an investment grade rating to low-income and vulnerable countries, which can only borrow on shorter terms and at excessively high interest rates. Reforms to the credit rating system should be undertaken to recognize the long-term growth potential of developing and vulnerable countries. Only in this way will these countries be able to benefit from innovative financing tools such as SDG bonds, which have already been successfully used by other developing economies such as Benin (see the Benin Sustainable Development Report 2022) to accelerate the implementation of the 2030 Agenda.