Coordinating disparate sources of finance to achieve the SDGs

If generating the finance to achieve the SDGs seemed a tall order pre-pandemic, it looks much harder now. We must rapidly accelerate the take-up of financial instruments for sustainable development, and attract a wider range of investors, if we’re to meet the 2030 deadline

Financing — Global, Latin America and the Caribbean

The COVID-19 pandemic and environmental deterioration (reflected in climate change, water scarcity, and the extinction of countless species) are exacerbating structural problems such as poverty in developed and developing economies alike. One way to face these challenges is by improving the coordination of finance to achieve the Sustainable Development Goals (SDGs). This article addresses two important dimensions. First, the challenge of mobilizing resources from the public and private sectors to face a post-COVID-19 world. And, second, the general conditions for issuers and investors to be able to connect the demand and supply of resources for the SDGs with acceptable levels of risk.

COVID-19 has caused the most severe economic, social, and human crisis since the second world war. To date more than 130 million people have been infected and about 3 million people have died. The crisis has further exacerbated the needs that were dire even prior to the pandemic, one of which is how to finance the 17 SDGs.

SDG financing and the pandemic

Before the COVID-19 pandemic, achieving the SDGs by 2030 required bridging a finance gap of an estimated $2.5 trillion a year. In 2020 alone, $1 trillion in external financing was earmarked for emerging and low-income economies to soften the economic effects of the pandemic. Currently, it is estimated that returning to the previous path to reach the SDGs by 2030, some $4.5 trillion will be needed annually. This requires a major effort in resource mobilization.

To measure the economic, social, and environmental effects of the pandemic, note that in just a few months, progress in the fight against poverty fell back by at least two years, exposing some 100 million people to the brink of extreme poverty. The fall in economic activity has meant a loss of close to 3.5% in global output with the consequent destruction of more than 200 million jobs. Meanwhile, figures from the International Energy Agency show that after a steep drop in CO2e emissions in early 2020 (meaning overall emissions for the year as a whole fell 6%), emissions had rebounded by December, up 2% compared with the year before.

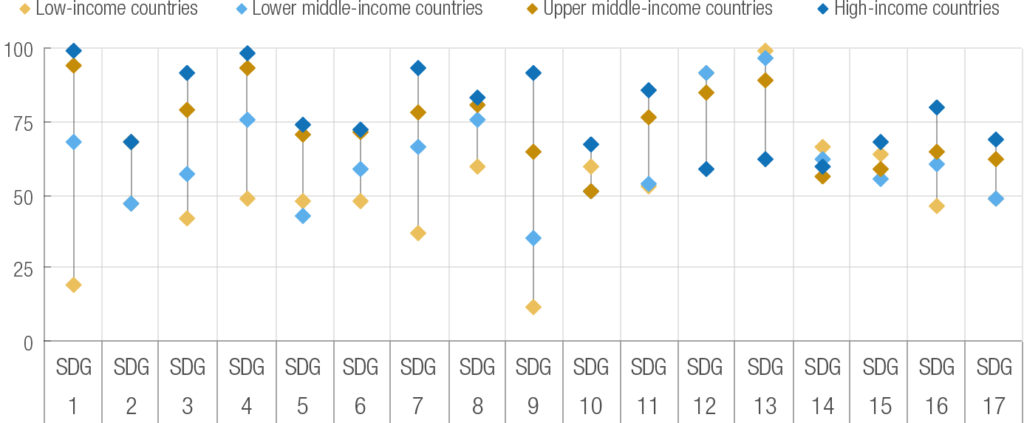

The financial situation countries face, whether looking at their own budgets or factoring in external resources, is challenging. Developed countries expect a total debt of 124% of GDP by 2021, similar to that registered after the second world war. Developing countries, meanwhile, are set to reach debt levels equivalent to 62.5% of GDP, the highest since records began. Figure 1 shows that the SDG financing needs in developing countries grouped by income level vary greatly between regions and levels of development.

Figure 1: SDG financing needs and public stimulus packages in developing countries

Source: OECD, Global Outlook on Financing for Sustainable Development 2021

Progress towards the SDGs

Another way of discussing the challenge of financing from private and public sources is by looking at the progress towards sustainable development across the Global Goals.

Between 2015 and 2019, the world made significant progress towards eliminating poverty (SDG 1). Extreme poverty, although not eradicated, was on a downward trend, reaching 8.2% in 2019 due to rapid economic growth, especially in East and South Asia. Progress in health outcomes (SDG 3) and educational attainment (SDG 4) was also notable, with heavy investment in schools, immunization campaigns, and maternal health, although progress toward other goals, such as achieving reading literacy, was slower. Investment in infrastructure also increased significantly. For example, electrification rates (SDG 7) increased globally from 83% to 90% between 2010 and 2019, and industrialization (SDG 9) increased slightly in less developed countries.

Figure 2: the SDGs in 2020

Source: OECD, Global Outlook on Financing for Sustainable Development 2021

But progress towards other SDGs has stalled or reversed. Food insecurity (SDG 2) rose between 2015 and 2018. Inequalities (SDG 10) have increased in some regions, as affluent people have continued to see their wealth and income rise while protection of the most vulnerable has weakened. Progress for girls and women (SDG 5) has been uneven. The global material footprint (SDG 12) continues on an unsustainable path, while global greenhouse gas emissions increased between 2015 and 2019, with no signs of reduction. Biodiversity has decreased. Fish populations have continued to decline (SDG 14) and species extinctions threaten sustainable development and compromise the world’s global heritage. These extinctions are driven primarily by habitat loss from unsustainable agricultural practices, as well as trade, deforestation and invasive alien species] (SDG 15). Furthermore, the proportion of the urban population living in slums is once again growing after years of decline. Access to water and sanitation is not improving due to rapid urbanization (SDG 11).

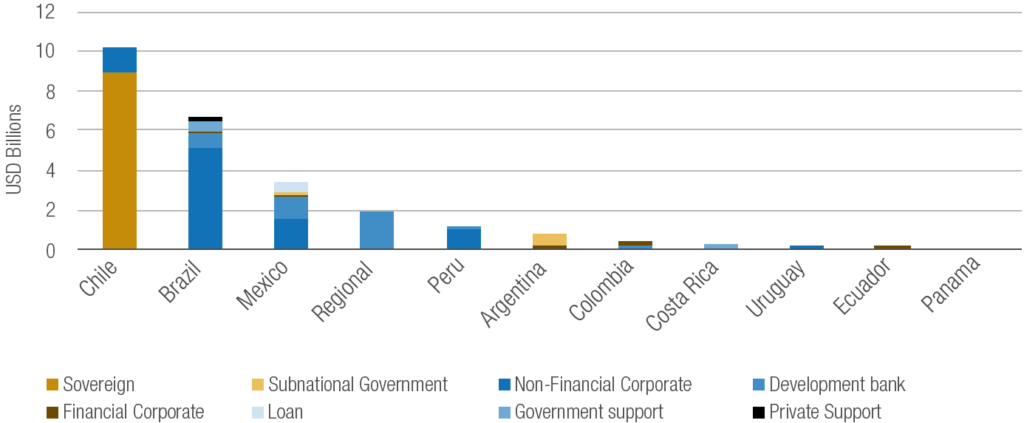

Green bonds and ESG criteria: lessons and challenges

Two approaches that governments, companies, and organisations can use to finance projects that seek to mitigate and adapt to climate change (and pursue social objectives) are green bonds (sovereign and corporate) and more generally the promotion of environmental, social, and governance (ESG) investment criteria. Figure 3 shows the green and social financing (mainly bonds) in Latin America, one of the regions with the greatest dynamism in the sustainable and green bond market. As the figure shows, only a few countries have made extensive use of ESG financing, most notably Chile, Brazil, and Mexico.

Figure 3: sustainable and green financing by country

Source: Gonzales (2021)

The slow development of these financing sources in several countries may be partly caused by the lack of understanding about these instruments and the difficulties in the certification and identification of projects that are required.

For sovereign issuers, it is important to create an institutional base to establish the roles of national agencies in the measurement, reporting, and verification of projects. This would allow countries to determine the types of eligible public spending and the sectors that can be financed. Countries must also develop a comprehensive framework within the public sector to improve the processes of selecting and allocating resources transparently and efficiently.

It’s important to make potential investors aware of the financial benefits that these options represent. In the Chilean case, the green bond achieved a 5 basis points premium (lower yield) over comparable non-green sovereign securities. Issuers also need to reach out to the wide variety of potential, perhaps non-traditional, investors who may be attracted by these specific types of instruments.

One other aspect to consider is the heterogeneity in investment metrics, ratings and approaches that makes it difficult for regulators, investors and issuers to assess the performance of these instruments. Market participants often lack the tools they need, such as consistent data, comparable metrics, and transparent methodologies, to adequately inform decisions, manage risks, measure results, and align investments with long-term sustainable value. This is despite the proliferation of ratings, methodologies, and metrics. So there must be a general taxonomy to facilitate the participation of investors.

If these challenges are addressed, ESG instruments can be a powerful way to finance the SDGs as the world recovers from COVID-19.

References

Boitreaud S., Gonzales-Carrasco L., Gurhy B., Emery T., Larrain F., and Paladines C. (2021) Paving the Path: Lessons from Chile’s Experiences as a Sovereign Issuer for Sustainable Finance Action. World Bank report forthcoming

Djankov, S. and U. Panizza (eds.) (2020), COVID-19 in Developing Economies, Center for Economic Policy Research, London

Gonzales-Carrasco L. (2021) Adaptación al Cambio Climático: En Chile los Bonos Verdes empiezan a mostrar sus frutos, Punto de no retorno CLAPES UC, available here

IEA (2021) After steep drop in early 2020, global carbon dioxide emissions have rebounded strongly, available here

Renita Pinto, A., A. Bhowmwick and R. Kapoor Adlakha (2020), How did India’s rural economy fare through the COVID-19 lockdown and the re-opening?, World Bank Blogs

UN 2019, Global Sustainable Development Report 2019: The Future is Now – Science for Achieving Sustainable Development, Independent Group of Scientists appointed by the Secretary-General, United Nations, New York

UN 2020, Report of the Secretary-General – Progress towards the Sustainable Development Goals, United Nations Economic and Social Council, New York